質問 1:Clark bought Series EE U.S. Savings Bonds after 1989. Redemption proceeds will be used for payment of

college tuition for Clark's dependent child. One of the conditions that must be met for tax exemption of

accumulated interest on these bonds is that the:

A. Purchaser of the bonds must be the sole owner of the bonds (or joint owner with his or her spouse).

B. Bonds must be bought by a parent (or both parents) and put in the name of the dependent child.

C. Bonds must be bought by the owner of the bonds before the owner reaches the age of 24.

D. Bonds must be transferred to the college for redemption by the college rather than by the owner of the

bonds.

正解:A

解説: (Topexam メンバーにのみ表示されます)

質問 2:Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable

income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own

and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994

Form 1040.

In 1994, Joan received $1,300 in unemployment compensation benefits. Her employer made a $100

contribution to the unemployment insurance fund on her behalf.

A. $1,000

B. $1,500

C. $900

D. $500

E. $10,000

F. $75,000

G. $1,300

H. $55,000

I. $0

J. $25,000

K. $1,250

L. $50,000

M. $3,000

N. $2,500

O. $2,000

正解:G

解説: (Topexam メンバーにのみ表示されます)

質問 3:Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable

income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own

and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994

Form 1040.

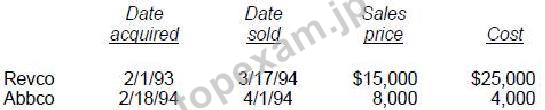

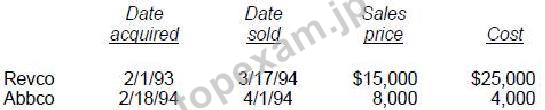

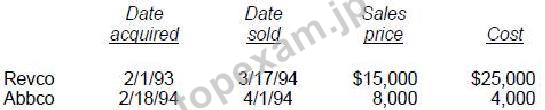

The Moores had no capital loss carryovers from prior years. During 1994, the Moores had the following

stock transactions, which resulted in a net capital loss:

A.

A. $1,000

B. $1,500

C. $900

D. $500

E. $10,000

F. $75,000

G. $1,300

H. $55,000

I. $0

J. $25,000

K. $1,250

L. $50,000

M. $3,000

N. $2,500

O. $2,000

正解:M

解説: (Topexam メンバーにのみ表示されます)

質問 4:Which of the following is subject to the Uniform Capitalization Rules of Code Sec. 263A?

A. Editorial costs incurred by a freelance writer.

B. Research and experimental expenditures.

C. Mine development and exploration costs.

D. Warehousing costs incurred by a manufacturing company with $12 million in annual gross receipts.

正解:D

解説: (Topexam メンバーにのみ表示されます)

質問 5:Under a $150,000 insurance policy on her deceased father's life, May Green is to receive $12,000 per

year for 15 years. Of the $12,000 received in 1987, the amount subject to income tax is:

A. $1,000

B. $0

C. $12,000

D. $2,000

正解:D

解説: (Topexam メンバーにのみ表示されます)

質問 6:An individual had the following capital gains and losses for the year:

What will be the net gain (loss) reported by the individual and at what applicable tax rate(s)?

A. Short-term loss of $3,000 at the ordinary rate, long-term capital gain of $10,000 at the 15% rate,

collectibles gain of $10,000 at the 28% rate, and Section 1250 gain of $56,000 at the 25% rate.

B. Long-term capital gain of $3,000 at the 15% rate, collectibles gain of $10,000 at the 28% rate, and

Section 1250 gain of $56,000 at the 25% rate.

C. Long-term gain of $16,000 at the 15% rate.

D. Short-term loss of $3,000 at the ordinary rate and long-term capital gain of $86,000 at the 15% rate.

正解:C

解説: (Topexam メンバーにのみ表示されます)

質問 7:Freeman, a single individual, reported the following income in the current year:

Guaranteed payment from services rendered to a partnership $50,000

Ordinary income from a S corporation $20,000

What amount of Freeman's income is subject to self-employment tax?

A. $20,000

B. $70,000

C. $0

D. $50,000

正解:D

解説: (Topexam メンバーにのみ表示されます)

弊社は無料AICPA REGサンプルを提供します

お客様は問題集を購入する時、問題集の質量を心配するかもしれませんが、我々はこのことを解決するために、お客様に無料REGサンプルを提供いたします。そうすると、お客様は購入する前にサンプルをダウンロードしてやってみることができます。君はこのREG問題集は自分に適するかどうか判断して購入を決めることができます。

REG試験ツール:あなたの訓練に便利をもたらすために、あなたは自分のペースによって複数のパソコンで設置できます。

一年間の無料更新サービスを提供します

君が弊社のAICPA REGをご購入になってから、我々の承諾する一年間の更新サービスが無料で得られています。弊社の専門家たちは毎日更新状態を検査していますから、この一年間、更新されたら、弊社は更新されたAICPA REGをお客様のメールアドレスにお送りいたします。だから、お客様はいつもタイムリーに更新の通知を受けることができます。我々は購入した一年間でお客様がずっと最新版のAICPA REGを持っていることを保証します。

TopExamは君にREGの問題集を提供して、あなたの試験への復習にヘルプを提供して、君に難しい専門知識を楽に勉強させます。TopExamは君の試験への合格を期待しています。

安全的な支払方式を利用しています

Credit Cardは今まで全世界の一番安全の支払方式です。少数の手続きの費用かかる必要がありますとはいえ、保障があります。お客様の利益を保障するために、弊社のREG問題集は全部Credit Cardで支払われることができます。

領収書について:社名入りの領収書が必要な場合、メールで社名に記入していただき送信してください。弊社はPDF版の領収書を提供いたします。

弊社は失敗したら全額で返金することを承諾します

我々は弊社のREG問題集に自信を持っていますから、試験に失敗したら返金する承諾をします。我々のAICPA REGを利用して君は試験に合格できると信じています。もし試験に失敗したら、我々は君の支払ったお金を君に全額で返して、君の試験の失敗する経済損失を減少します。

弊社のAICPA REGを利用すれば試験に合格できます

弊社のAICPA REGは専門家たちが長年の経験を通して最新のシラバスに従って研究し出した勉強資料です。弊社はREG問題集の質問と答えが間違いないのを保証いたします。

この問題集は過去のデータから分析して作成されて、カバー率が高くて、受験者としてのあなたを助けて時間とお金を節約して試験に合格する通過率を高めます。我々の問題集は的中率が高くて、100%の合格率を保証します。我々の高質量のAICPA REGを利用すれば、君は一回で試験に合格できます。

AICPA CPA Regulation 認定 REG 試験問題:

1. Leker exchanged a van that was used exclusively for business and had an adjusted tax basis of $20,000

for a new van. The new van had a fair market value of $10,000, and Leker also received $3,000 in cash.

What was Leker's tax basis in the acquired van?

A) $20,000

B) $17,000

C) $13,000

D) $7,000

2. Gibson purchased stock with a fair market value of $14,000 from Gibson's adult child for $12,000. The

child's cost basis in the stock at the date of sale was $16,000. Gibson sold the same stock to an unrelated

party for $18,000. What is Gibson's recognized gain from the sale?

A) $4,000

B) $0

C) $6,000

D) $2,000

3. Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable

income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own

and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994

Form 1040.

The Moores had no capital loss carryovers from prior years. During 1994, the Moores had the following

stock transactions, which resulted in a net capital loss:

A) $1,000

B) $1,500

C) $900

D) $500

E) $10,000

F) $75,000

G) $1,300

H) $55,000

I) $0

J) $25,000

K) $1,250

L) $50,000

M) $3,000

N) $2,500

O) $2,000

4. Hall, a divorced person and custodian of her 12-year old child, filed her 1990 federal income tax return as

head of a household. She submitted the following information to the CPA who prepared her 1990 return:

. In 1990, Hall sold an antique that she bought in 1980 to display in her home. Hall paid $800 for the

antique and sold it for $1,400, using the proceeds to pay a court ordered judgment.

The $600 gain that Hall realized on the sale of the antique should be treated as:

A) Ordinary income.

B) Long-term capital gain.

C) An involuntary conversion.

D) A nontaxable antiquities transaction.

5. Rich is a cash basis self-employed air-conditioning repairman with 1993 gross business receipts of

$ 20,000. Rich's cash disbursements were as follows:

What amount should Rich report as net self-employment income?

A) $14,100

B) $14,900

C) $15,100

D) $13,900

質問と回答:

質問 # 1

正解: B | 質問 # 2

正解: D | 質問 # 3

正解: M | 質問 # 4

正解: B | 質問 # 5

正解: C |

PDF版 Demo

PDF版 Demo

品質保証TopExamは我々の専門家たちの努力によって、過去の試験のデータが分析されて、数年以来の研究を通して開発されて、多年の研究への整理で、的中率が高くて99%の通過率を保証することができます。

品質保証TopExamは我々の専門家たちの努力によって、過去の試験のデータが分析されて、数年以来の研究を通して開発されて、多年の研究への整理で、的中率が高くて99%の通過率を保証することができます。 一年間の無料アップデートTopExamは弊社の商品をご購入になったお客様に一年間の無料更新サービスを提供することができ、行き届いたアフターサービスを提供します。弊社は毎日更新の情況を検査していて、もし商品が更新されたら、お客様に最新版をお送りいたします。お客様はその一年でずっと最新版を持っているのを保証します。

一年間の無料アップデートTopExamは弊社の商品をご購入になったお客様に一年間の無料更新サービスを提供することができ、行き届いたアフターサービスを提供します。弊社は毎日更新の情況を検査していて、もし商品が更新されたら、お客様に最新版をお送りいたします。お客様はその一年でずっと最新版を持っているのを保証します。 全額返金弊社の商品に自信を持っているから、失敗したら全額で返金することを保証します。弊社の商品でお客様は試験に合格できると信じていますとはいえ、不幸で試験に失敗する場合には、弊社はお客様の支払ったお金を全額で返金するのを承諾します。(

全額返金弊社の商品に自信を持っているから、失敗したら全額で返金することを保証します。弊社の商品でお客様は試験に合格できると信じていますとはいえ、不幸で試験に失敗する場合には、弊社はお客様の支払ったお金を全額で返金するのを承諾します。( ご購入の前の試用TopExamは無料なサンプルを提供します。弊社の商品に疑問を持っているなら、無料サンプルを体験することができます。このサンプルの利用を通して、お客様は弊社の商品に自信を持って、安心で試験を準備することができます。

ご購入の前の試用TopExamは無料なサンプルを提供します。弊社の商品に疑問を持っているなら、無料サンプルを体験することができます。このサンプルの利用を通して、お客様は弊社の商品に自信を持って、安心で試験を準備することができます。