質問 1:Taft Corp. discloses supplemental industry segment information. The following information is available for

1 992:

Additional 1992 expenses, not included above, are as follows:

Indirect operating expenses $7,200

General corporate expenses 4,800

Segment C's 1992 operating profit was:

A. $2,600

B. $5,000

C. $3,200

D. $2,000

正解:B

解説: (Topexam メンバーにのみ表示されます)

質問 2:A segment of Ace Inc. was discontinued during 1992. Ace's loss from discontinued operations should not:

A. Exclude operating losses from the date the decision to dispose of the segment was made until the end

of 1992.

B. Include employee relocation costs associated with the decision to dispose.

C. Include additional pension costs associated with the decision to dispose.

D. Include operating losses of the current period up to the date the decision to dispose of the segment

was made.

正解:A

解説: (Topexam メンバーにのみ表示されます)

質問 3:Which of the following statements is incorrect regarding the inputs that can be used to measure fair

value?

I. Level I inputs are the most reliable fair value measurements and Level III inputs are the least reliable.

II. Level I measurements are quoted prices in active markets for identical or similar assets or liabilities.

III. A fair value measurement based on management assumptions only (no market data) would not be

acceptable per GAAP.

IV. The level in the fair value hierarchy of a fair value measurement is determined by the level of the

highest level significant input.

A. II, III, IV.

B. I, II, IV.

C. I only.

D. I, II, III, IV.

正解:A

解説: (Topexam メンバーにのみ表示されます)

質問 4:In 1992, hail damaged several of Toncan Co.'s vans. Hailstorms had frequently inflicted similar damage to

Toncan's vans. Over the years, Toncan had saved money by not buying hail insurance and either paying

for repairs, or selling damaged vans and then replacing them. In 1992, the damaged vans were sold for

less than their carrying amount. How should the hail damage cost be reported in Toncan's 1992 financial

statements?

A. The expected average hail damage loss in continuing operations, with no separate disclosure.

B. The actual 1992 hail damage loss as an extraordinary loss, net of income taxes.

C. The expected average hail damage loss in continuing operations, with separate disclosure.

D. The actual 1992 hail damage loss in continuing operations, with no separate disclosure.

正解:D

解説: (Topexam メンバーにのみ表示されます)

質問 5:The following items were among those that were reported on Lee Co.'s income statement for the year

ended December 31, 1989:

The office space is used equally by Lee's sales and accounting departments. What amount of the above

listed items should be classified as general and administrative expenses in Lee's multiple-step income

statement?

A. $325,000

B. $410,000

C. $500,000

D. $290,000

正解:D

解説: (Topexam メンバーにのみ表示されます)

質問 6:Hyde Corp. has three manufacturing divisions, each of which has been determined to be a reportable

segment. In 1989, Clay division had sales of $3,000,000, which was 25% of Hyde's total sales, and had

operating costs of $1,900,000, as reported to the CFO. In 1989, Hyde incurred operating costs of

$ 500,000 that were not directly traceable to any of the divisions. In addition, Hyde incurred corporate

interest expense of $300,000 in 1989. In reporting segment information, what amount should be shown as

Clay's operating profit for 1989?

A. $900,000

B. $975,000

C. $875,000

D. $1,100,000

正解:D

解説: (Topexam メンバーにのみ表示されます)

質問 7:On August 31, 1992, Harvey Co. decided to change from the FIFO periodic inventory system to the

weighted average periodic inventory system. Harvey is on a calendar year basis. The cumulative effect of

the change is determined:

A. As of January 1, 1992.

B. During 1992 by a weighted average of the purchases.

C. As of August 31, 1992.

D. During the eight months ending August 31, 1992, by a weighted average of the purchases.

正解:A

解説: (Topexam メンバーにのみ表示されます)

質問 8:On December 2, 20X1, Flint Corp.'s board of directors voted to discontinue operations of its frozen food

division and to sell the division's assets on the open market as soon as possible. The division reported net

operating losses of $20,000 in December and $30,000 in January. On February 26, 20X2, sale of the

division's assets resulted in a gain of $90,000. Assuming that the frozen foods division qualifies as a

component of the business and ignoring income taxes, what amount of gain/loss from discontinued

operations should Flint recognize in its income statement for 20X2?

A. $60,000

B. $90,000

C. $40,000

D. $0

正解:A

解説: (Topexam メンバーにのみ表示されます)

質問 9:The cumulative effect of a change in accounting estimate should be shown separately:

A. On the income statement above income from continuing operations.

B. On the retained earnings statement as an adjustment to the beginning balance.

C. On the income statement after income from continuing operations and before extraordinary items.

D. It should not be recorded separately on any financial statement.

正解:D

解説: (Topexam メンバーにのみ表示されます)

弊社は失敗したら全額で返金することを承諾します

我々は弊社のFAR問題集に自信を持っていますから、試験に失敗したら返金する承諾をします。我々のAICPA FARを利用して君は試験に合格できると信じています。もし試験に失敗したら、我々は君の支払ったお金を君に全額で返して、君の試験の失敗する経済損失を減少します。

弊社のAICPA FARを利用すれば試験に合格できます

弊社のAICPA FARは専門家たちが長年の経験を通して最新のシラバスに従って研究し出した勉強資料です。弊社はFAR問題集の質問と答えが間違いないのを保証いたします。

この問題集は過去のデータから分析して作成されて、カバー率が高くて、受験者としてのあなたを助けて時間とお金を節約して試験に合格する通過率を高めます。我々の問題集は的中率が高くて、100%の合格率を保証します。我々の高質量のAICPA FARを利用すれば、君は一回で試験に合格できます。

安全的な支払方式を利用しています

Credit Cardは今まで全世界の一番安全の支払方式です。少数の手続きの費用かかる必要がありますとはいえ、保障があります。お客様の利益を保障するために、弊社のFAR問題集は全部Credit Cardで支払われることができます。

領収書について:社名入りの領収書が必要な場合、メールで社名に記入していただき送信してください。弊社はPDF版の領収書を提供いたします。

弊社は無料AICPA FARサンプルを提供します

お客様は問題集を購入する時、問題集の質量を心配するかもしれませんが、我々はこのことを解決するために、お客様に無料FARサンプルを提供いたします。そうすると、お客様は購入する前にサンプルをダウンロードしてやってみることができます。君はこのFAR問題集は自分に適するかどうか判断して購入を決めることができます。

FAR試験ツール:あなたの訓練に便利をもたらすために、あなたは自分のペースによって複数のパソコンで設置できます。

TopExamは君にFARの問題集を提供して、あなたの試験への復習にヘルプを提供して、君に難しい専門知識を楽に勉強させます。TopExamは君の試験への合格を期待しています。

一年間の無料更新サービスを提供します

君が弊社のAICPA FARをご購入になってから、我々の承諾する一年間の更新サービスが無料で得られています。弊社の専門家たちは毎日更新状態を検査していますから、この一年間、更新されたら、弊社は更新されたAICPA FARをお客様のメールアドレスにお送りいたします。だから、お客様はいつもタイムリーに更新の通知を受けることができます。我々は購入した一年間でお客様がずっと最新版のAICPA FARを持っていることを保証します。

AICPA CPA Financial Accounting and Reporting 認定 FAR 試験問題:

1. On December 31, 20X2, the Board of Directors of Maxy Manufacturing, Inc. committed to a plan to

discontinue the operations of its Alpha division. Maxy estimated that Alpha's 20X3 operating loss would

be $500,000 and that the fair value of Alpha's facilities was $300,000 less than their carrying amounts.

Alpha's 20X2 operating loss was $1,400,000, and the division was actually sold for $400,000 less than its

carrying amount in 20X3. Maxy's effective tax rate is 30%.

In its 20X2 income statement, what amount should Maxy report as loss from discontinued operations?

A) $1,190,000

B) $1,700,000

C) $980,000

D) $1,400,000

2. Tanker Oil Co., a development stage enterprise, incurred the following costs during its first year of

operations:

Tanker had no revenue during its first year of operation. What amount may Tanker capitalize as

organizational costs?

A) $95,000

B) $55,000

C) $0

D) $115,000

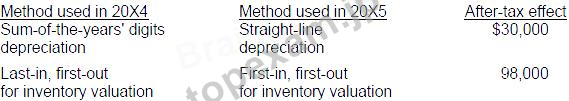

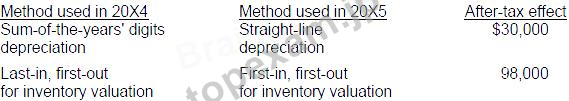

3. During 20X5, Dale Corp. made the following accounting changes:

What amount should be shown in the 20X5 retained earnings statement as an adjustment to the

beginning balance?

A) $98,000

B) $128,000

C) $0

D) $30,000

4. On January 2, 20X5, to better reflect the variable use of its only machine, Holly, Inc. elected to change its

method of depreciation from the straight-line method to the units of production method. The original cost

of the machine on January 2, 20X3, was $50,000, and its estimated life was 10 years. Holly estimates that

the machine's total life is 50,000 machine hours. Machine hours usage was 8,500 during 20X4 and 3,500

during 20X3.

Holly's income tax rate is 30%. Holly should report the accounting change in its 20X5 financial statements

as a(n):

A) Cumulative effect of a change in accounting principle of $1,400 in its income statement.

B) None of the above.

C) Adjustment to beginning retained earnings of $2,000.

D) Cumulative effect of a change in accounting principle of $2,000 in its income statement.

5. Adam Corp. had the following infrequent transactions during 1989:

. A $190,000 gain on reacquisition and retirement of bonds. This material event is also considered

unusual for Adam Corp.

. A $260,000 gain on the disposal of a component of a business. Adam continues similar operations at

another location.

. A $90,000 loss on the abandonment of equipment.

In its 1989 income statement, what amount should Adam report as total infrequent net gains that are not

considered extraordinary?

A) $450,000

B) $100,000

C) $360,000

D) $170,000

質問と回答:

質問 # 1

正解: A | 質問 # 2

正解: C | 質問 # 3

正解: A | 質問 # 4

正解: B | 質問 # 5

正解: D |

PDF版 Demo

PDF版 Demo

品質保証TopExamは我々の専門家たちの努力によって、過去の試験のデータが分析されて、数年以来の研究を通して開発されて、多年の研究への整理で、的中率が高くて99%の通過率を保証することができます。

品質保証TopExamは我々の専門家たちの努力によって、過去の試験のデータが分析されて、数年以来の研究を通して開発されて、多年の研究への整理で、的中率が高くて99%の通過率を保証することができます。 一年間の無料アップデートTopExamは弊社の商品をご購入になったお客様に一年間の無料更新サービスを提供することができ、行き届いたアフターサービスを提供します。弊社は毎日更新の情況を検査していて、もし商品が更新されたら、お客様に最新版をお送りいたします。お客様はその一年でずっと最新版を持っているのを保証します。

一年間の無料アップデートTopExamは弊社の商品をご購入になったお客様に一年間の無料更新サービスを提供することができ、行き届いたアフターサービスを提供します。弊社は毎日更新の情況を検査していて、もし商品が更新されたら、お客様に最新版をお送りいたします。お客様はその一年でずっと最新版を持っているのを保証します。 全額返金弊社の商品に自信を持っているから、失敗したら全額で返金することを保証します。弊社の商品でお客様は試験に合格できると信じていますとはいえ、不幸で試験に失敗する場合には、弊社はお客様の支払ったお金を全額で返金するのを承諾します。(

全額返金弊社の商品に自信を持っているから、失敗したら全額で返金することを保証します。弊社の商品でお客様は試験に合格できると信じていますとはいえ、不幸で試験に失敗する場合には、弊社はお客様の支払ったお金を全額で返金するのを承諾します。( ご購入の前の試用TopExamは無料なサンプルを提供します。弊社の商品に疑問を持っているなら、無料サンプルを体験することができます。このサンプルの利用を通して、お客様は弊社の商品に自信を持って、安心で試験を準備することができます。

ご購入の前の試用TopExamは無料なサンプルを提供します。弊社の商品に疑問を持っているなら、無料サンプルを体験することができます。このサンプルの利用を通して、お客様は弊社の商品に自信を持って、安心で試験を準備することができます。